Facts About Eb5 Investment Immigration Revealed

Facts About Eb5 Investment Immigration Revealed

Blog Article

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

Table of ContentsSee This Report about Eb5 Investment ImmigrationFascination About Eb5 Investment ImmigrationHow Eb5 Investment Immigration can Save You Time, Stress, and Money.Everything about Eb5 Investment ImmigrationThe 3-Minute Rule for Eb5 Investment Immigration

Contiguity is developed if demographics systems share boundaries. To the level feasible, the combined census tracts for TEAs ought to be within one metro area without any greater than 20 demographics tracts in a TEA. The mixed census systems ought to be an uniform form and the address ought to be centrally located.For even more information concerning the program go to the united state Citizenship and Immigration Services website. Please enable 1 month to refine your demand. We normally respond within 5-10 service days of obtaining qualification requests.

The U.S. federal government has taken steps aimed at boosting the level of foreign financial investment for virtually a century. In the Migration Act of 1924, Congress introduced the E-1 treaty trader class to assist assist in trade by international vendors in the USA on a short-lived basis. This program was expanded through the Immigration and Nationality Act (INA) of 1952, which created the E-2 treaty investor class to further bring in international investment.

employees within 2 years of the immigrant financier's admission to the USA (or in particular conditions, within a reasonable time after the two-year duration). Additionally, USCIS might attribute capitalists with maintaining tasks in a troubled business, which is defined as a business that has been in existence for a minimum of 2 years and has actually suffered a bottom line during either the previous year or 24 months prior to the top priority date on the immigrant investor's initial application.

A Biased View of Eb5 Investment Immigration

The program maintains strict capital demands, needing candidates to show a minimum certifying investment of $1 million, or $500,000 if spent in "Targeted Work Locations" (TEA), that include certain assigned high-unemployment or country areas. Most of the authorized local facilities develop investment possibilities that are situated in TEAs, which certifies their international financiers for the lower financial investment threshold.

To get approved for an EB-5 visa, a financier needs to: Spend or be in the procedure of investing at the very least $1.05 million in a brand-new company in the United States or Invest or be in the process of spending at the very least $800,000 in a Targeted Employment Area. EB5 Investment Immigration. (On March 15, 2022, these amounts boosted; prior to that day, the united state

A lot more especially, it's an area that's experiencing a minimum of 150 percent of the nationwide typical rate of unemployment. There are some exemptions to the $1.05 million business investment. One strategy is by setting up the financial investment service in a financially tested area. You may contribute a lesser commercial financial investment of $800,000 in a rural area with much less than 20,000 in population.

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

Regional Center financial investments permit for the consideration of economic impact on the local economic climate in the kind of indirect employment. Any kind of capitalist considering investing with a Regional Facility need to be very careful to take into consideration the experience and success rate of the firm before spending.

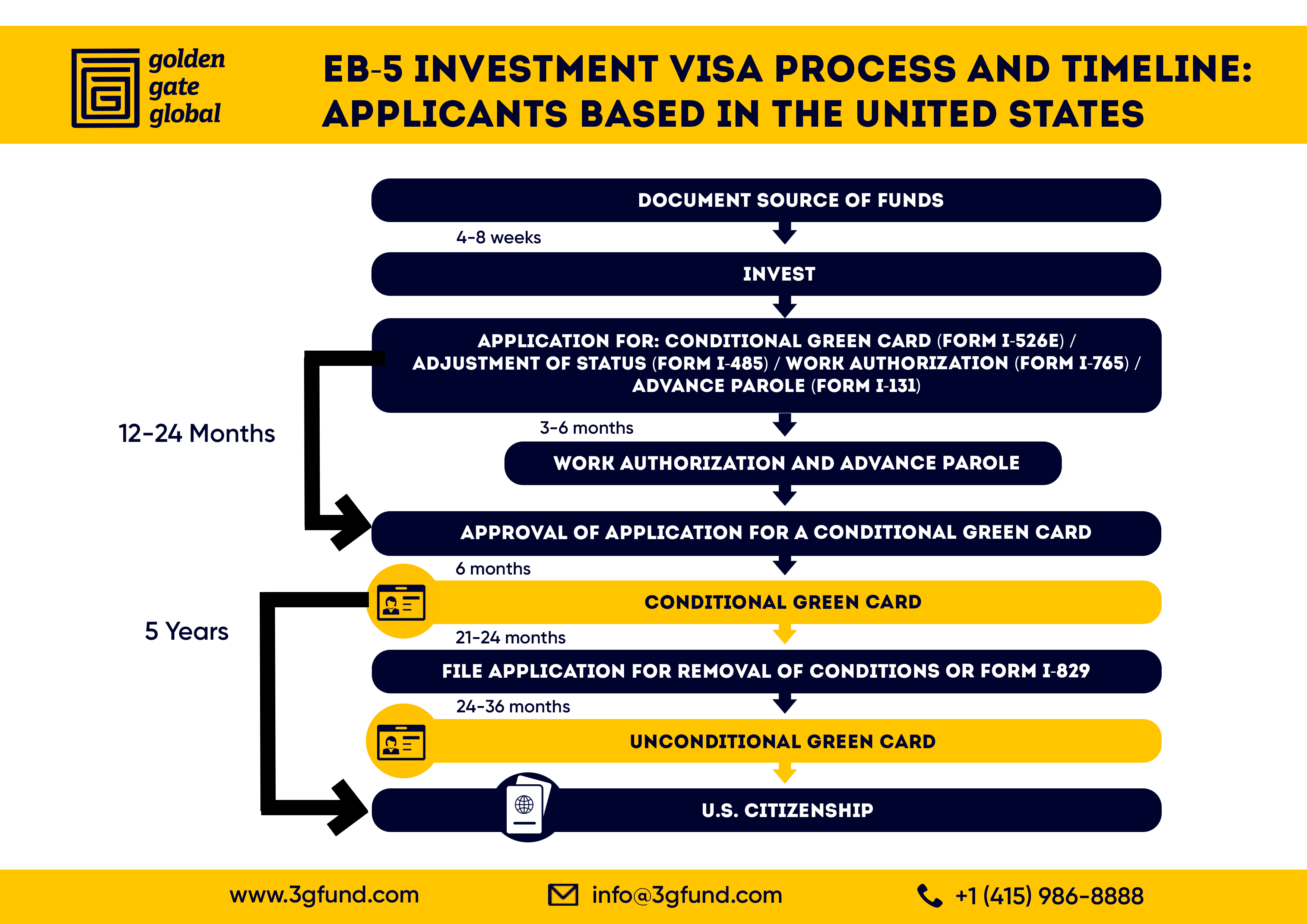

The capitalist initially needs to file an I-526 application with U.S. Citizenship and Immigration Solutions (USCIS). This request needs to consist of evidence that the investment will develop permanent work for at the very least 10 united state citizens, long-term residents, or other immigrants that are accredited to work in the United States. After USCIS authorizes the I-526 application, the financier may obtain a copyright.

The Definitive Guide for Eb5 Investment Immigration

If the investor is outside the United States, they will need to go via consular processing. Capitalist eco-friendly cards come with conditions connected.

Yes, in particular conditions. The EB-5 Reform and Integrity Act of 2022 (RIA) added area 203(b)( 5 )(M) to the INA. The new area usually allows good-faith capitalists to maintain their qualification after termination of their local facility or debarment of their NCE or JCE. After we notify financiers of the discontinuation or debarment, they may keep qualification either by notifying us that they proceed to fulfill qualification needs regardless of the discontinuation or debarment, or by changing their request to show that they meet the requirements under section 203(b)( 5 )(M)(ii) of the INA (which has different needs depending on whether the Click Here capitalist is looking for to preserve qualification since their local facility was terminated or since their NCE or JCE was debarred).

In all cases, we will certainly make such determinations constant with USCIS policy regarding submission to prior resolutions to guarantee regular adjudication. After we terminate a local center's designation, we will certainly revoke any type of Kind I-956F, Application for Approval of a Financial Investment in a Business, related to the ended regional center like it if the Kind I-956F was approved as of the day on the regional center's discontinuation notice.

Top Guidelines Of Eb5 Investment Immigration

Report this page