The Best Guide To Estate Planning Attorney

The Best Guide To Estate Planning Attorney

Blog Article

The 2-Minute Rule for Estate Planning Attorney

Table of ContentsEstate Planning Attorney Fundamentals ExplainedThe Buzz on Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.The Ultimate Guide To Estate Planning Attorney

Your lawyer will additionally assist you make your files authorities, scheduling witnesses and notary public trademarks as essential, so you don't need to bother with trying to do that last action on your very own - Estate Planning Attorney. Last, however not the very least, there is beneficial comfort in developing a connection with an estate planning attorney that can be there for you down the roadPut simply, estate planning attorneys supply worth in several means, far past merely supplying you with published wills, trust funds, or various other estate preparing papers. If you have concerns concerning the procedure and wish to discover more, contact our office today.

An estate planning attorney assists you formalize end-of-life choices and lawful files. They can establish wills, establish trust funds, produce healthcare regulations, establish power of attorney, develop succession plans, and extra, according to your wishes. Collaborating with an estate planning attorney to complete and supervise this legal documentation can help you in the complying with eight locations: Estate intending lawyers are professionals in your state's count on, probate, and tax obligation laws.

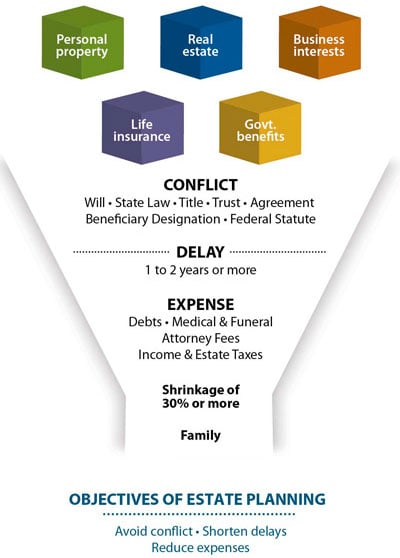

If you do not have a will, the state can choose how to divide your assets amongst your successors, which might not be according to your dreams. An estate planning attorney can help arrange all your lawful files and disperse your assets as you desire, potentially staying clear of probate.

Estate Planning Attorney - An Overview

Once a customer passes away, an estate plan would certainly dictate the dispersal of properties per the deceased's instructions. Estate Planning Attorney. Without an estate plan, these choices might be left to the near relative or the state. Duties of estate organizers include: Creating a last will and testimony Establishing trust accounts Naming an administrator and power of attorneys Recognizing all beneficiaries Naming a guardian for small youngsters Paying all financial debts and lessening all tax obligations and lawful fees Crafting directions for passing your worths Establishing preferences for funeral plans Settling directions for care if you become sick and are unable to choose Getting life insurance policy, special needs income insurance coverage, and lasting care insurance A great estate strategy ought to be updated routinely as clients' financial circumstances, home individual inspirations, and federal and state regulations all progress

Similar to any kind of career, there are qualities and abilities that can help you accomplish these objectives as you deal with your customers in an estate organizer duty. An estate preparation career can be appropriate for you if you possess the adhering to attributes: Being an estate coordinator implies thinking in the long-term.

4 Easy Facts About Estate Planning Attorney Explained

You must aid your client expect his/her end of life and what will happen postmortem, while at the same time not house on somber thoughts or emotions. Some customers may come to be bitter or anxious when pondering death and it could be up to you to assist them with it.

In the event of death, you might be expected to have numerous conversations and ventures with surviving relative about the estate plan. In order to succeed as an estate coordinator, you may need to stroll a fine line of being a shoulder to lean on and the specific counted on to communicate estate preparation matters in a prompt and specialist fashion.

tax obligation code changed hundreds of times in the 10 years between 2001 and 2012. Expect that it has actually been modified further considering that then. Depending upon your client's financial earnings bracket, which may advance toward end-of-life, you as an estate coordinator will go to my site certainly have to keep your customer's properties completely lawful compliance with any type of regional, government, or international tax legislations.

An Unbiased View of Estate Planning Attorney

Acquiring this accreditation from organizations like the National Institute of Qualified Estate Planners, Inc. can be a strong differentiator. Being a participant of these expert groups can verify your abilities, making you extra appealing in the eyes of a prospective customer. Along with the emotional reward of assisting customers with end-of-life planning, estate planners enjoy the benefits of a steady earnings.

Estate planning is a smart point to do regardless of your present health and economic condition. The initial important point is to work with an estate planning lawyer to assist you with it.

An experienced lawyer recognizes what information to include in the will, including your beneficiaries and unique factors to consider. It likewise offers his explanation the swiftest and most effective technique to transfer your assets to your beneficiaries.

Report this page